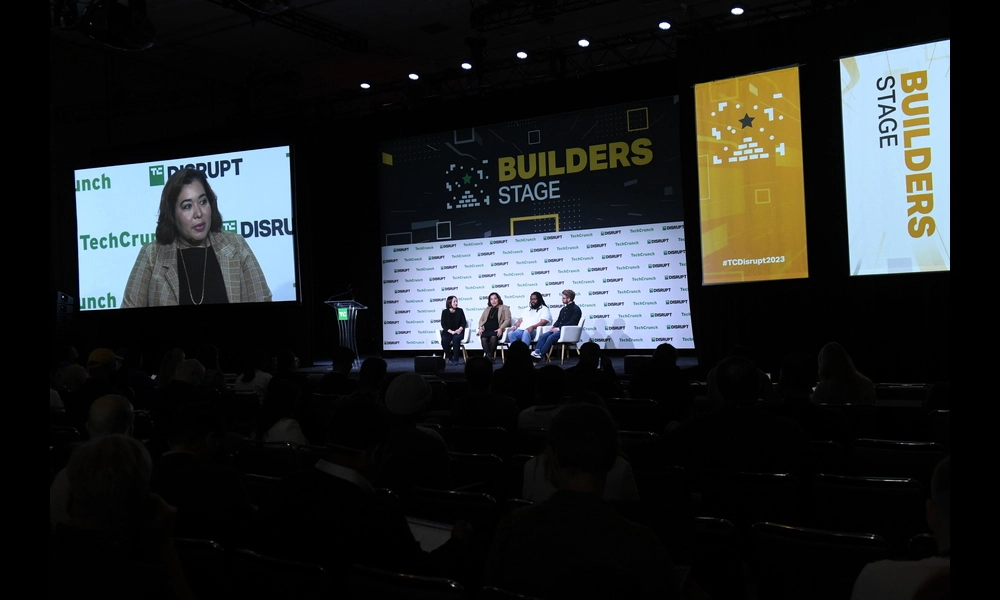

How Are Venture Capital and Innovation Connected?

Published on Wed Dec 13 2023 How to Build a VC Firm in Public | TechCrunch on Flickr

How to Build a VC Firm in Public | TechCrunch on FlickrIn a groundbreaking study emerging from Paris, researchers have painted a vivid picture of the ties that bind venture capitalists (VCs) and technological innovation. Venture capital investment, recognized as a major force propelling startups and novel technologies, takes center stage in a complex web determining the future of artificial intelligence, medicine, and quantum computing. With crises upheaving the stability of these connections more frequently than ever, understanding the resilience of these financial-technological interactions is critical.

The study unveils a profound interconnectedness akin to mutualistic interactions in ecosystems—where various species rely on each other for survival. Here, the 'species' are generalist investors and general-purpose technologies. By meticulously analyzing data from extensive financial, startup, and patent databases, the researchers found the investor-technology network is starkly mutualistic, where diversely invested venture capitalists link with technologies that span multiple sectors.

So why does this matter? A mutualistic network, with its high level of interconnectedness and interactions, can influence the robustness of technological innovation in times of crisis. In ecological terms, nestedness describes a community where each member is connected to others in a manner similar to Russian nesting dolls—each fitting within another. The study identified this nestedness in the investor-patent network, which could mean greater resilience against unexpected upheavals. In simpler terms, because investors are not putting all their eggs in one technological basket, the entire system is less likely to crumble if one area faces challenges.

However, the low modularity—a measure of how clustered the network is—suggests that while there's a strong overall interrelation, the investors and technologies aren't forming tightly-knit, isolated groups. This structure allows for the easy spread of both innovation and potential failure. Arising from the study is a warning: crises targeting generalist investors could be detrimental, possibly sending ripples through the vast network and threatening the diverse technological landscape.

The implications of these findings extend beyond current investment strategies. As startups continue to herald paradigm-shifting technologies, the resilience of the ever-critical investor-technology nexus can't be understated. This study not only illuminates the often-unexplored firmament of venture capital's role in shaping the future but also raises important considerations about maintaining stability in the face of global economic or societal challenges.